RBA WTS Vietnam News

Foreign Capital in Vietnam

With Decree 29, the government of Vietnam instructed the local authorities to strictly supervise and evaluate foreign investments.

Foreign Contractor Withholding Tax in Vietnam

The Foreign Contractor Withholding Tax applies to certain payments by a Vietnamese contracting party to foreign parties earning income from Vietnam without setting up a legal entity in Vietnam.

Vietnam: “Royalty” fees for imported goods

On 23 August 2022, the General Department of Customs issued the Official Letter No. 3489/TCHQ-TXNK with new guidance on the declaration of royalty for imported goods.

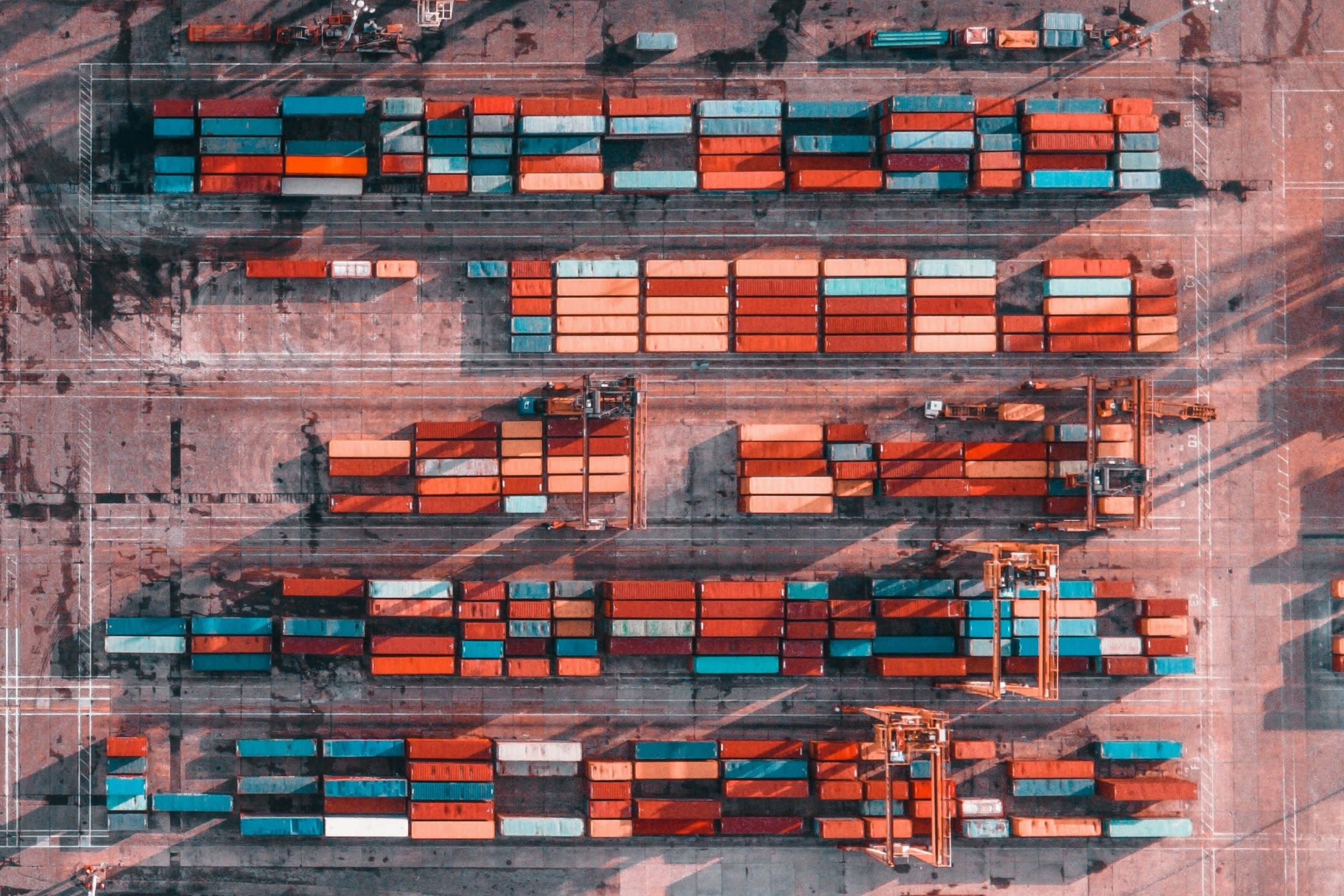

Global Customs Newsletter #1/2023

News on trade and customs developments from all over the world

Post-pandemic Asia Pacific: Taxation fast lanes and speed bumps

Post-Covid Asia Pacific recovery promises new opportunities for businesses. However, the need to replenish coffers, the changing international tax and geo-political landscape will pose challenges for tax regulators and tax leaders.

Vietnam: Work Permit issues

Decree No. 152/2020/ND-CP (“Decree 152”) came into effect on 15 February 2021 and made the conditions for obtaining a work permit (“WP”) stricter.

Global Mobility Newsletter #1/2022

The Global Mobility environment is changing in a dynamic way.

Vietnam: Goods labeling

Decree 111/2021/NF-CP on goods labeling came into effect on 15 February 2022 and has eliminated some uncertainties.

Global Customs Newsletter #2/2022

News on trade and customs developments from all over the world

Webinar Invitation – Tax Challenges of Global Mobility in Asia Pacific

Monday, 20 June 2022

Vietnam: VAT rate reductions

The regular VAT rate of 10% is reduced to 8% from 1 February 2022 until the end of 2022.

Global Mobility Service brochure “Assignments to Vietnam”

This booklet offers you a brief overview of tax, social security and immigration related matters you might consider for your cross-border work.