COVID-19: Tax implications in Vietnam

A. Tax Reduction by 30% for SME’s

On 19 June 2020, the National Assembly approved the 30% reduction in the Corporate Income Tax (CIT) for 2020 for entities

with annual revenue of up to VND 200 billion (around USD 8.6 Mio).

B. Extending deadline for tax payments

With Decree No. 41/2020/ND-CP – Decree on extending the deadline for paying tax and land rent issued on 08 April 2020 having

immediate effect, the Ministry of Finance of Vietnam clarified the relief for certain sectors of business which are especially effected

by the COVID-19 crisis.

No extension is granted for declaring tax.

- Procedure and timeline

For benefitting from the granted extensions of the timelines for paying tax and land rent, the taxpayer must send a written request

for extension of tax payment and land rent to the immediate managing tax authority by 30 July 2020. After this date, extensions

will not be granted. - Industries

The subjects eligible for extension of the deadlines are enterprises doing business in agriculture, manufacturing and processing of

food, wood, metal, mechanical processing, processing of electronic products, construction and transportation, labor and employment

services,accommodation service, travel agents, hotel, education, real estate, art, entertainment, production of industrial products supporting

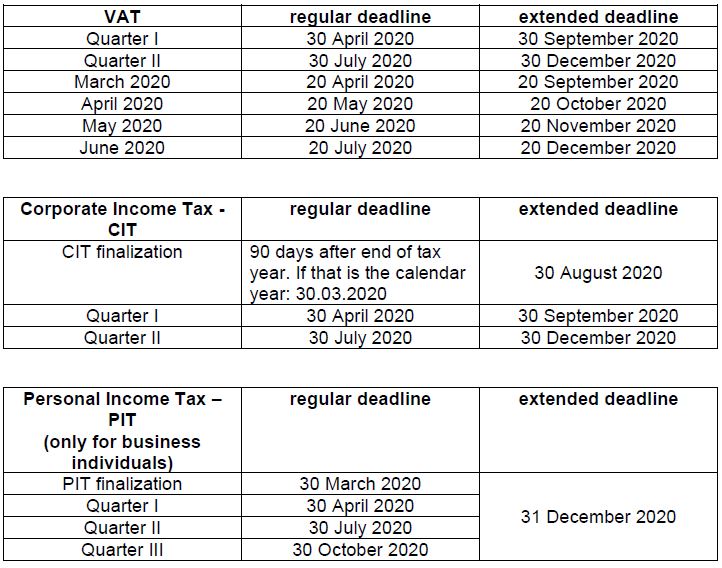

prioritized developments, etc. - Extensions

The extension will be granted for 5 months.

For land rent, also the 5-month extension applies.

C. Tax Audit

Tax audits for companies not having a suspicious status are not scheduled now, audits might be delayed until 2021. However, it is expected

that the tax audits will be taken up and intensified regarding foreign invested enterprises.

Wolfram Grünkorn

Chairman of the Members Council